Casino bonuses and free bet offers are key to the online gambling market. This research analyzes data from thousands of gamblers. It reveals the truth about promotional incentives in the Canadian and UK casino market. The findings show both chances and big worries for players in today’s online gambling world.

We took a deep dive into Canadian and UK casinos to see how bonuses really impact players — and here are the results:

These findings demonstrate measurable impacts on player behavior across different demographics and risk levels.

This article is based on comprehensive research conducted by the UK Gambling Commission. The regulatory body surveyed around 8,000 adult gamblers. They explored how these gamblers experienced casino bonuses and free bet offers. This study is one of the largest looks at gambling promotions.

The comprehensive study is available at the Gambling Commission's official website. By examining players of all ages and risk levels, we uncovered how promotional incentives can sway behavior.

Even though the study looked at the UK, Canadian players can relate to a lot of what it found. Online gambling doesn’t care about borders - similar tricks and promotions pop up everywhere. The same kinds of incentives and psychological nudges that influence UK players are at work for Canadians too.

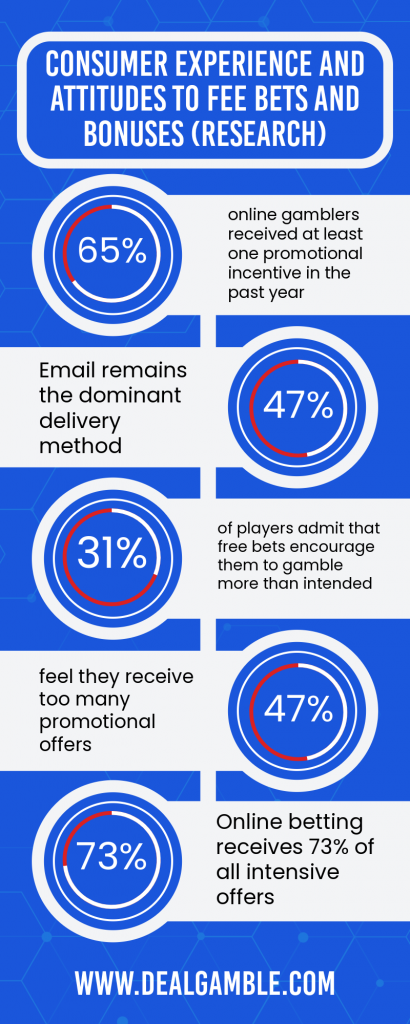

The research shows that casino bonuses are now pervasive in online gambling, with 65% of players receiving at least one offer annually. This indicates that the majority of active players are consistently exposed to promotions. To win over players, operators throw out all kinds of bonuses. It’s how they fight for market share.

Here are shown the most common bonus types:

| Incentive type | Persentage |

|---|---|

| Free bets/spins | 58% |

| Sign-up offers | 54% |

| Reminders with a bonus | 41% |

| Other offers | 19% |

Sign-up offers followed closely at 54%, demonstrating their importance in customer acquisition strategies. Interestingly, 41% received reminder messages with bonus incentives, showing that operators actively work to re-engage existing customers as well as attract new ones.

Here are shown delivery methods:

| Method | Persentage |

|---|---|

| 47% | |

| Social media ads | 21% |

| Text message | 17% |

| Gambling app | 16% |

| Search engine ads | 15% |

| Non-gambling app | 8% |

Emails dominate at 47%, making it the most effective channel for reaching players. Social media advertising emerged as the second most common method, at 21% reflecting the gambling industry’s shift toward digital platforms. Text messages reached 17% of players, creating more immediate and instructive contact. Gambling app notifications similarly saw a 16% contraction in users.

The frequency of bonus offers varies somewhat by delivery method. However, the overall pattern reveals consistent, high-volume marketing across all available channels. Operators have developed sophisticated multi-channel strategies. These strategies help them maintain constant contact with their customer base.

Here are shown the inventive frequencies by platform:

| Platform | Daily | Weekly | Monthly |

|---|---|---|---|

| 7% | 51% | 84% | |

| Text message | 8% | 58% | 85% |

| Gambling app | 9% | 58% | 88% |

| Social media | 8% | 54% | 86% |

Almost every player gets some kind of monthly bonus, with numbers sitting around 84-88%. And it’s not just in a while - over half get nudged every week through texts or app alerts. This highlights the consistent, multi-platform marketing strategies targeting players frequently.

The research highlights that problem gamblers receive promotional offers far more frequently than other players. It reveals a troubling pattern across PGSI risk levels. This raises serious questions about how operators identify and communicate with vulnerable customers. Whether through deliberate targeting or algorithmic bias, these gamblers face significantly greater promotional pressure than recreational gamblers.

Here are shown daily incentives by risk level:

| Player category | Daily incentives |

|---|---|

| Non-problem gambler | 4% |

| Low-risk gambler | 7% |

| Moderate risk gambler | 7% |

| Problem gambler | 35% |

Problem gamblers experience far higher promotional exposure, with 35% receiving daily offers compared to just 4% of non-problem gamblers, raising ethical concerns. This may result from algorithmic targeting of high-frequency players or multiple platform registrations, both leading to overlapping offers. Either way, it highlights systemic issues in how the industry engages its most vulnerable customers.

Here are shown daily receptions by gender:

| Gender | Daily incentives |

|---|---|

| Male | 8% |

| Female | 12% |

And daily receptions by age:

| Age group | Daily incentives |

|---|---|

| 18 to 24 | 8% |

| 25 to 34 | 16% |

| 35 to 44 | 11% |

| 45 to 54 | 9% |

| 55 to 64 | 7% |

| 65 and over | 2% |

Players aged 25-34 receive the highest rate at 16%, double that of the youngest group. Meanwhile, players 65 and older receive daily offers at just 2%.

The research asked participants detailed questions about whether they agreed with various statements about promotional offers. The results reveal complex and sometimes contradictory attitudes that suggest many players don’t fully recognize how bonuses influence their decisions.

Here are shown behavioral impacts:

| Statement | Agress | Disagree |

|---|---|---|

| Bonuses don’t change my gambling | 61% | 21% |

| Bonuses encourage excessive gambling | 31% | 50% |

| First time gambling due to the bonus | 28% | 59% |

| Tried a new company due to the bonus | 35% | 51% |

| Started a new activity due to the bonus | 28% | 57% |

| Restarted after the break due to the bonus | 21% | 63% |

Although 61% of players believe bonuses don’t affect their gambling, 31% admit they lead to excess play, highlighting a gap between perception and behavior. Promotions also influence player choice, with 35% trying new operators and 28% starting new gambling activities due to targeted offers. This demonstrates how bonuses shape behavior, drive competition, and expand gambling participation.

Here are shown player preferences:

| Statement | Agree | Disagree |

|---|---|---|

| I like receiving bonuses | 39% | 41% |

| I receive too many incentives | 47% | 27% |

| I prefer not to receive bonuses | 48% | 31% |

Opinion is divided, with 47% feeling overwhelmed by promotional volume. Almost half of the people don’t want bonus offers anymore.

The research revealed stark differences in how various demographic groups respond to casino bonuses. These patterns have important implications for both regulatory police and responsible gaming initiatives.

Here are shown attitudes by gender:

| Statement | Male | Female |

|---|---|---|

| Like receiving bonuses | 45% | 32% |

| Bonuses encourage excess | 31% | 30% |

| First time due to the bonus | 24% | 33% |

| Prefer not to receive | 43% | 55% |

Men appreciate bonuses at 45%, while 55% of women prefer not to receive them. However, women showed higher rates of first-time gambling due to bonuses at 33% versus 24% for men. This shows that women might be more swayed by initial promotions.

Here are shown attitudes by age:

| Statement | x25-34 | 25-34 | 35-44 | 45-54 | 55-64 | 65+ |

|---|---|---|---|---|---|---|

| Like bonuses | 52% | 53% | 54% | 36% | 21% | 16% |

| Encourage excess | 39% | 46% | 39% | 27% | 19% | 8% |

| Don’t change gambling | 54% | 50% | 59% | 61% | 70% | 76% |

| Prefer not to receive | 40% | 37% | 37% | 47% | 66% | 70% |

Young adults ages 18-34 are especially at risk from gambling incentives. About 39-46% say these offers lead to excessive gambling. This shows a clear need for focused, responsible gaming efforts. Older gamblers resist change. Most say promotions don’t affect their behavior. They also prefer to skip special deals. Policymakers should set age-appropriate limits on aggressive marketing.

Canadian players should be careful with offers. If promotions make them uncomfortable, they should unsubscribe from marketing. Remember, they can fully opt out anytime. Setting strict deposit limits before claiming incentives helps prevent overspending. Reviewing wagering requirements is key. Many rewards have high playthrough conditions that can make withdrawals tricky.

Never chase specials beyond your budget, as the odds always favor the house. Players aged 18-34 should think about opting out of marketing. Promotional deals can lead to too much gambling. In fact, 31% say they feel pushed beyond their limits. Casinos create rewards to encourage spending using behavioral strategies. By knowing this, players can make smarter and more informed choices.

DealGamble offers Canadian players transparent, research-based casino reviews that go beyond promotional hype. They check operators for fair offers, reasonable wagering, and responsible marketing. They focus on those who respect gambling limits. The platform empowers players with honest, data-driven guidance to make informed gambling decisions.

Casino incentives clearly impact gambler behavior, especially among vulnerable groups. The Gambling Commission data shows that 35% of problem gamblers get daily offers. Also, 77% say promotions lead them to gamble more. These statistics should concern both regulators and responsible operators.

Canadian players should be careful with gambling deals. These offers aim to encourage spending by using targeted strategies. If you think rewards push you too far, manage your exposure. Unsubscribe from marketing, set deposit limits, and add responsible gaming.